Innofactor as an Investment

Innofactor Plc shares were delisted from the official list of Nasdaq Helsinki on April 25, 2025.

The Leading Driver of the Modern Digital Organization in the Nordic Countries

Innofactor is the leading driver of the modern digital organization in the Nordic Countries for its about 1,000 customers in commercial and public sector. Innofactor has the widest solution offering and leading know-how in the Microsoft ecosystem in the Nordics. Innofactor has about 600 enthusiastic and motivated top specialists in Finland, Sweden, Denmark and Norway.

#AIDriven #PeopleFirst #BeTheRealYou

Latest Stock Exchange Releases

CEO's Review

March 31, 2025

Innofactor celebrates its 25th anniversary – our goal is to take our customers' use of AI to the next level

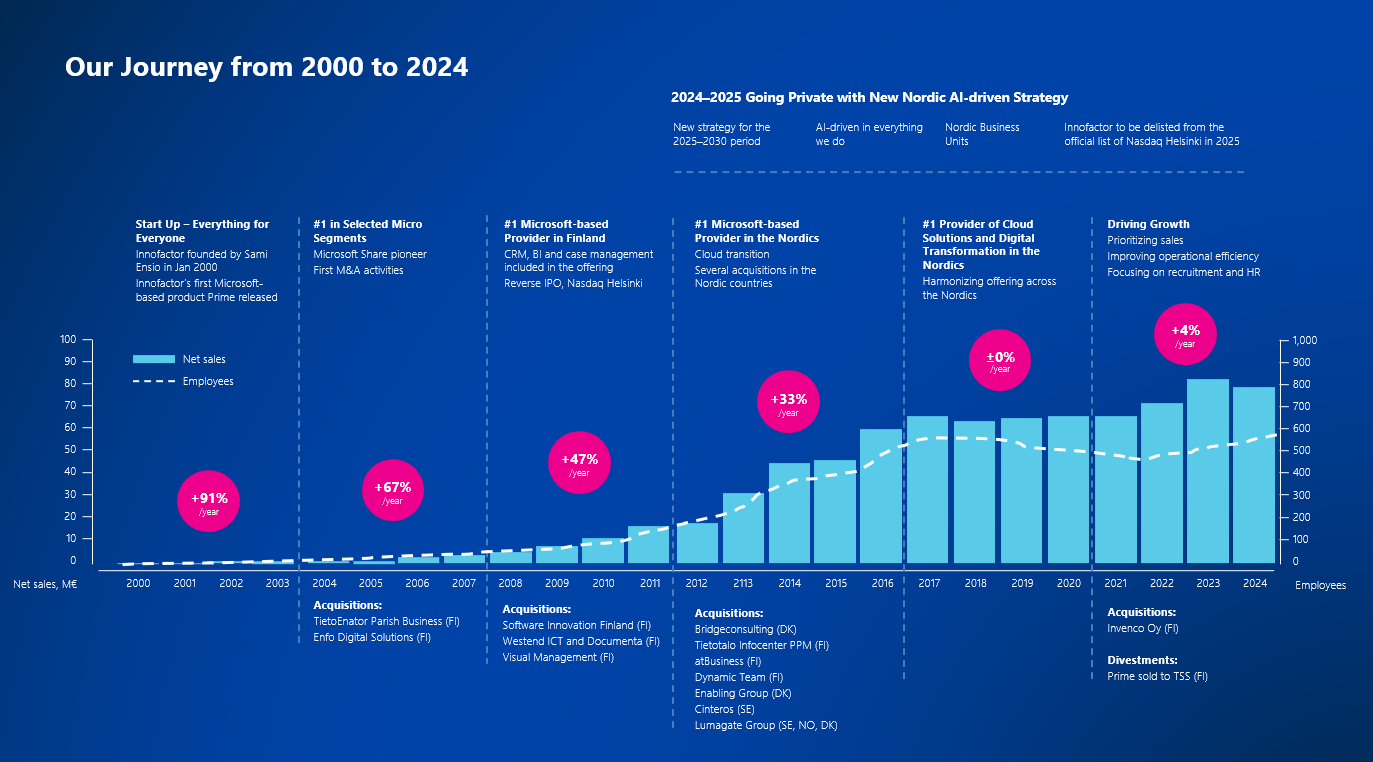

I founded Innofactor 25 years ago. The journey from a one-person business to a leading Microsoft solutions provider with approximately 600 employees in the Nordic countries has been full of twists and turns, but we have always made systematic progress. I am very lucky to have had the opportunity to work with incredible people: customers, partners, colleagues, and investors. You can read more about Innofactor's 25-year journey in our anniversary book at www.innofactor.com/25.

The year 2025 is our jubilee year, during which I hope to celebrate our shared achievements with as many of you as possible!

We are starting 2025 with an updated strategy, which emphasizes the utilization of AI in everything we do, along with an even stronger customer orientation and our Nordic expertise. We restructured our offering and organization around four main areas: Platforms, Solutions, Code, and Dynasty. We believe that this enables us to offer even clearer, higher-quality and more cost-effective solutions and services to our customers. We focus on developing our customers' utilization of artificial intelligence, particularly in a process- and function-oriented manner, using AI agents. We are incorporating AI into our own products, especially Dynasty.

I want to thank all of our customers for joining us on this historic journey to make the most of innovation.

Our strategy is focused on the Microsoft offering and Microsoft platforms. As the markets are changing, Microsoft and its partners are growing much faster than the IT market on average. In particular, Microsoft's investment in OpenAI and subsequent market leadership in generative AI will boost Innofactor's ability to serve our customers. Our partnership with Microsoft is very strong. This is evidenced by Innofactor having achieved all seven Microsoft Solutions Partner designations, five Microsoft Specializations and, in 2024, the Microsoft Breakthrough Business Case Partner of the Year award, as well as the Partner Ecosystem Award, which was awarded to me personally. I would like to thank Microsoft and our other partners in the Microsoft ecosystem for their trust in Innofactor.

Innofactor's strength lies in our highly competent and motivated personnel. We were successful in our recruitment activities in 2024 and managed to maintain our number of personnel at the previous year's level in spite of the challenging market situation. We strengthened our team, trained our personnel, completed certifications and developed our organization and management style. We want to do everything we can to ensure our continued success in the future. I am proud of our employees' enthusiasm toward driving the organization in the same direction and finding new ways to innovate solutions, improve customer satisfaction continuously, work more efficiently, and increase productivity. For that, I am grateful to all of you.

At Innofactor, we consider sustainability as one of the cornerstones of our long-term success. Our digital solutions play an important role in curbing climate change and promoting sustainable development. We see sustainability not only as a prerequisite for business continuity but also as an opportunity for innovation and building a modern digital organization. People play a key role in the success of our business, which is why the importance of social responsibility is emphasized. We put people first, invest in well-being at work and competence development, and we are fair, diverse and inclusive. More information on our social responsibility is provided in our first sustainability report, which you can find at the end of the Report of the Board of Directors.

Our anniversary year in 2025 will also be bittersweet in a sense. Innofactor's 14-year journey as a listed company is very likely to conclude this year as a result of the public tender offer that was carried out in 2024 and the subsequent redemption proceedings concerning the remaining shares. During our time as a listed company, we achieved strong growth in the Nordic countries in line with our strategy, using our listed share as a means of payment for acquisitions, and Kauppalehti ranked Innofactor as the most successful listed company in Finland in 2013. Of course, the years also included more challenging times, such as the financial crisis, the integration of acquired companies and the COVID-19 pandemic.

Delisting the company is not an easy decision for me, personally. However, I am confident that, in the present moment, it is unquestionably the best move with regard to the company's success, customers, employees and investors. I want to take this opportunity to thank all of the investors and partners who have been part of our journey, and I wish you all success in the future.

We work together with our customers, partners and employees to continuously innovate solutions that help our customers and society as a whole to function even more effectively. We are moving forward with enthusiasm and confidence.

"In 2025, we will focus on developing our customers' utilization of artificial intelligence, particularly in a process- and function-oriented manner, using AI agents. At the same time, we will celebrate Innofactor's tremendous 25-year journey together."

Sami Ensio

Innofactor's founder, major owner, and CEO

Business Environment

Market outlook and business environment: We expect that the growth rate of the Nordic IT services market will be positive in 2025 but, due to the geopolitical situation and the general economic downturn, we are not able to provide a more accurate estimate.

The market outlook and business environment are published in their entirety in the financial statement and in the Annual Report.

The price competition that began in the market in 2023 remained intense and, in our assessment, the weighted average prices of new contracts stayed at a low level until the end of the year, particularly in the case of public sector customers, in spite of a slight increase during the year. We estimate that the IT services market in the Nordic countries did not grow in 2024. We expect the average prices of new contracts to continue to increase in 2025. We estimate that the Nordic IT services market will grow slightly in 2025, but because of the uncertain economic and security policy situation, we cannot give a more detailed estimate of the rate of growth. Our estimate is based on research institutes' forecasts and our own outlook on markets.

Generative AI has attracted a great deal of interest in the market. Generative AI presents our customers – and Innofactor – with significant opportunities for improving operational efficiency. Above all, it opens up significant new business opportunities, for which we offer solutions developed by Microsoft as well as our own solutions. However, AI projects in the first phase have, in many cases, remained at the stage of experimentation in organizations. We believe that, during 2025, our customer base will continue to develop AI projects, especially agent-based solutions for certain processes and functions that are significant for each organization. Innofactor sees a significant role for itself in this trend. In 2025, we will also continue to develop the AI capabilities of our own products, especially Dynasty.

Climate change mitigation and the geopolitical situation place new demands on both societies and organizations, creating new business opportunities and accelerating innovation. The abilities of a modern digital organization will be even more important for our customers in the future. It is also likely that some of our customers will transfer some of their operations back to the Nordic countries in order to be closer to their customers. This could have a favorable effect as regards the business model of Innofactor's chosen strategy based on Nordic specialists. Microsoft's position has also strengthened in recent years as a market leader in generative AI, among other things. We believe in our chances of increasing our market share in the Nordic countries.

Purpose, Mission, Vision and Strategy

Innofactor's strategy comprises our purpose, mission, vision, strategic choices, values, working principle, employer promise, and long-term financial goals.

Our purpose

Innovating to make the world work better

Our mission

Driving the modern digital organization

Our vision

The most-wanted Nordic IT and AI partner specializing in Microsoft

Our strategic choices

- AI as a part of all activities

- Customer orientation - a trusted sparring partner

- Clear and distinctive offerings

- Leveraging Nordic strengths

Our values

- Accountability

- Empowerment

- Innovation

- Customer

Read more about our values.

Our sustainability strategy

- We innovate for good

- We put people first

- We are fair

- We build trust

Employee value proposition

Be the real you

Our long-term financial goals

-

To achieve annual growth of about 20 percent, of which majority is intended to be achieved by organic growth

-

To achieve about 20 percent EBITDA in relation to the net sales

-

To keep the cash flow positive and secure solid financial standing in all situations

Strategy and its realization in the review period

Innofactor's net sales for the period July 1–December 31, 2024, amounted to EUR 36,525 thousand (2023: 39,945), representing a decrease of 8.6 percent.

Innofactor's net sales for the period January 1–December 31, 2024, amounted to EUR 77,576 thousand (2023: 80,263), representing a decrease of 3.3 percent.

Innofactor's 10 largest clients accounted for approximately 34.9 percent of net sales for the review period January 1–December 31, 2024.

Innofactor's operating margin (EBITDA) for July 1–December 31, 2024, was EUR 3,134 thousand (2023: 4,849), representing a decrease of 35.4 percent. EBITDA was 8.6 percent of net sales (2023: 12.1%).

Innofactor's operating margin (EBITDA) for January 1–December 31, 2024, was EUR 6,338 thousand (2023: 9,101), representing a decrease of 30.4 percent. EBITDA was 8.2 percent of net sales (2023: 11.3%).

Innofactor's balance sheet total at the end of the review period was EUR 50,703 thousand (2023: 54,451). The Group's liquid assets totaled EUR 1,502 thousand (2023: 425), consisting entirely of cash funds.

The operating cash flow for the review period January 1–December 31, 2024, was EUR 8,094 thousand (2023: 7,229). Cash flow from investing activities was EUR -386 thousand (2023: -533).

The equity ratio at the end of the review period was 46.8 percent (2023: 48.3%) and net gearing was 30.1 percent (2023: 36.1%).

Key Figures

2024 |

2023 |

2022 |

2021 |

2020 |

|

|

Net sales, EUR thousand |

77,576 |

80,263 |

71,130 |

66,364 |

66,164 |

|

Operating profit before depreciation |

6,338 |

9,101 |

7,808 |

10,111 |

7,164 |

|

percentage of net sales |

8.2 % |

11.3% |

11.0% |

15.2% |

10.8% |

|

Operating profit (EBIT), EUR thousand |

3,386 |

5,835 |

4,751 |

6,519 |

2,501 |

|

percentage of net sales |

4.4 % |

7.3% |

6.7% |

9.8% |

3.8% |

|

Earnings before taxes, EUR thousand |

2,940 |

5,174 |

4,178 |

5,730 |

2,050 |

|

percentage of net sales |

3.8 % |

6.4% |

5.9% |

8.6% |

3.1% |

|

Earnings, EUR thousand |

263 |

3,438 |

3,320 |

4,504 |

1,761 |

|

percentage of net sales |

0.3 % |

4.3% |

4.7% |

6.8% |

2.7% |

|

Shareholders' equity, EUR thousand |

23,195 |

25,483 |

24,799 |

25,404 |

23,444 |

|

Interest bearing liabilities, EUR thousand |

4,342 |

6,325 |

14,349 |

9,818 |

15,386 |

|

Cash and cash equivalents, EUR thousand |

1,502 |

425 |

1,956 |

1,963 |

3,066 |

|

Deferred tax assets, EUR thousand |

293 |

2,415 |

4,090 |

4,830 |

6,413 |

|

Return on equity |

1.1 % |

13.7% |

13.2% |

18.4% |

7.7% |

|

Return on investment |

11.6 % |

18.0% |

14.5% |

20.6% |

11.1% |

|

Net Gearing |

30.1 % |

36.1% |

50.0% |

30.9% |

52.5% |

|

Equity ratio |

46.8 % |

48.3% |

44.8% |

51.1 % |

42.2% |

|

Balance sheet total, EUR thousand |

50,703 |

54,451 |

55,815 |

51,057 |

56,607 |

|

Research and development, EUR thousand |

5,558 |

5,108 |

4,153 |

3,504 |

3,618 |

|

percentage of net sales |

7.2 % |

6.4% |

5.8% |

5.3% |

5.5% |

|

Personnel on average during the year |

571 |

578 |

536 |

516 |

544 |

|

Personnel at the end of the year |

546 |

581 |

564 |

500 |

541 |

|

Number of shares at the end of the year |

35,789,319 |

36,343,691 |

37,388,225 |

37,388,225 |

37,388,225 |

|

Earnings per share (EUR) |

0.0 |

0.09 |

0.09 |

0.12 |

0.05 |

|

Shareholders' equity per share (EUR) |

0.6 |

0.70 |

0.68 |

0.68 |

0.63 |

Growth

Personnel

Be The Real You

Innofactor is a workplace where you can Be The Real You, and people are at the heart of everything we do. In line with our mission, we continue to build Innofactor as a modern digital organization. We develop our operating models to support the daily work of our employees within our Nordic organization. Highly competent and motivated employees, good leadership practices, self-organization, effective teamwork and company-wide practices support Innofactor's long-term goals. Our principle is to put People First in everything we do. We want to create an inspiring work environment for our employees where they can enjoy a strong sense of community and team spirit, and also have fun while working.

Number of Personnel

The average number of active personnel during the period January 1–December 31, 2024, was 571 (2023: 578), representing a decrease of 1.2 percent. At the end of the review period, the number of active personnel was 546 (2023: 581), representing a decrease of 6.0 percent.

At the end of the review period, the average age of the personnel was 42.1 years (2023: 42.1). Women accounted for 26 percent (2023: 26%) of the personnel. Men accounted for 74 percent (2023: 74%) of the personnel.

Offering

Innovating to Make the World Work Better

Innofactor's purpose is to innovate to make the world work better. Our purpose is based on the idea that technology can be used to promote good. We believe that, together with our personnel, partners and customers, we can make lives better, make work more efficient and meaningful, streamline operations, and drive growth and innovation across industries.

In 2024, we updated our strategy for 2025–2030. According to the updated strategy, our offering is divided into four main areas.

Innofactor Platforms: Leading platforms and experts for cloud infrastructure, data and analytics, as well as modern work and security solutions. The solutions are implemented using technologies such as Microsoft Azure, M365 and Copilot.

Innofactor's top Nordic expertise helps organizations unlock their full potential. We work with the customer to select the digital platforms that best suit their activities and are scalable to support changes in the organization's operations.

Innofactor Solutions: The best solutions and experts to support sales, financial management and operational activities. The solutions are implemented using technologies such as Microsoft Dynamics, Power Platform and Copilot, as well as Jedox.

Innofactor has deep industry expertise in manufacturing, construction, finance and public administration. With our expertise and modular Microsoft-based solutions, we turn strategies into tangible benefits, focusing on high-ROI changes to address each organization's most impactful challenges.

Innofactor Code: The most effective agile teams to implement customized solutions for process digitalization, integrations and low-code application management. The solutions are implemented using Microsoft Azure, Power Platform and Copilot, for example.

We offer customized AI-powered solutions for complex customer needs. Our solutions help organizations save time, reduce costs, improve the customer experience and deliver products and services faster.

Innofactor Dynasty: The most desired AI-powered solutions and expertise for document and records management, case and decision management, and contract and quality management. These solutions are available from Microsoft's Azure cloud on a SaaS basis or can be installed on the customers' own servers. The solutions are compatible with Microsoft M365 and Copilot.

The versatile Innofactor Dynasty product family is backed by over 30 years of development and has a strong focus on user-friendliness, functionality and data security, among other things. Our market-leading experience ensures the best possible outcomes for our customers.

While the technology and solutions we provide might sometimes seem complex, the objective is always the same: a more efficient, more effective organization with happier customers and more motivated employees, empowered by technology that makes daily work and life more meaningful. However, they allow us to create a more efficient and effective organization with satisfied customers and motivating work. Our solutions make work and life even more meaningful. The best way to measure the results of our work is how well we manage to bring a smile to the lips of the people who use our solutions. To ensure we carry on doing this, we never stop enhancing our own skills and expertise. As a result, we have achieved all seven Microsoft Solution Partner Designations and as many as five Microsoft Specializations. Read more about the awards.

Our Modern Delivery Model Ensures Effective Deployment and Adoption to Maximize the Lifetime Value of New Solutions

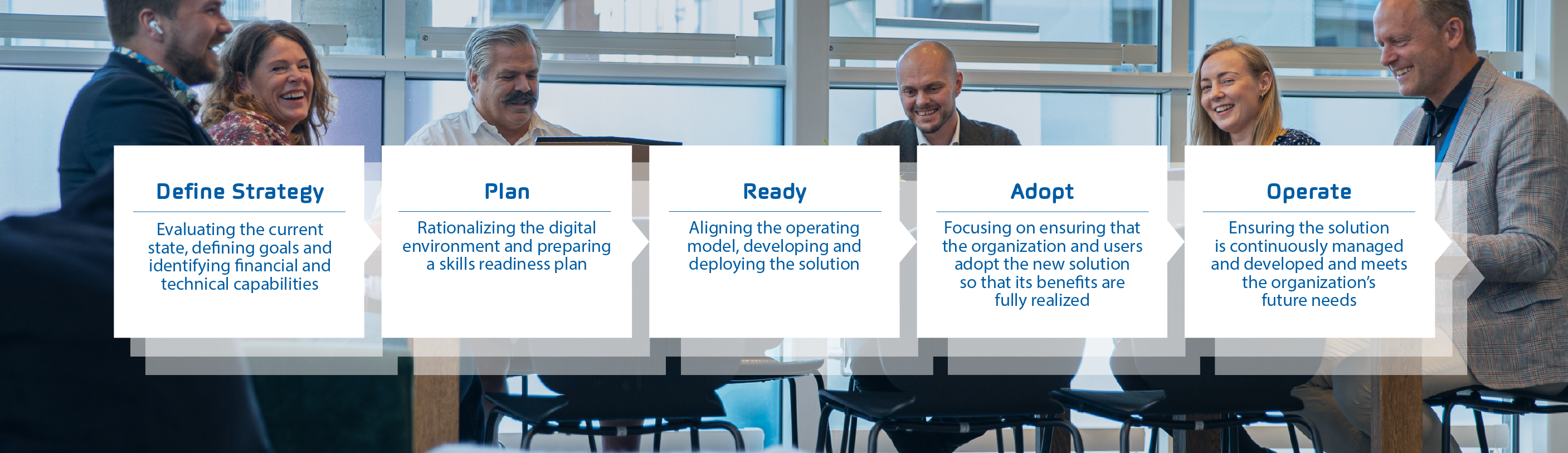

Our delivery model is based on years of experience in the successful design, adoption, and development of digital solutions and services. It consists of five stages, each of which delivers our customers quick, tangible value in each of the six areas of our offering. The value of our deliveries is based on not only helping our customers to specify their strategy and design and implement a specific solution but also supporting them through close collaboration in the deployment, use and continuous development of the solution.

read more about our solutions for modern digital organization

Acquisitions

20 June, 2022

Innofactor signed a contract to acquire the entire share capital of the Finnish company Invenco Oy.

See Stock Exchange Release for more details.

To clarify the group structure, the merger of Innofactor Invenco Oy's subsidiary Innofactor Invenco Software Oy into Innofactor Invenco Oy was initiated in 2022. The merger process is intended to be completed in spring 2023.

31 December, 2020

During the first quarter of 2020, Innofactor increased its holding in Arc Technology Oy by 26.94 percent to a total of 45.13 percent. Starting from the Q2/2020 interim report, Arc Technology Oy was reported as a subsidiary, because Innofactor has had control over the company since April 2020. Innofactor's holding in the company increased to 100% on December 30, 2020. For 2020, Arc Technology Oy increased Innofactor's net sales by approximately EUR 0.8 million. Arc Technology Oy was renamed as Innofactor HRM Oy in early 2021. See the Press Release (in Finnish).

10 October, 2016

Innofactor signed a contract to acquire the entire share capital of the Lumagate group.

See Stock Exchange Release for more details.

22 December, 2015

Innofactor signed a contract to acquire the entire share capital of the Swedish company Cinteros AB.

See Stock Exchange Release for more details.

22 December, 2015

Finnish Arc Technology, which is focused on HR systems, bought Innofactor Plc's HRM (Human Resources Management) business.

See press release for more details.

31 December, 2013

Innofactor signed a contract to acquire the entire share capital of Enabling Group.

See Stock Exchange Release for more details.

30 September, 2013

Innofactor acquired Dynamic Team (company name Lainetar Oy, based in Tampere, Finland) and its business in order to strengthen its offering in the Microsoft Dynamics AX business area.

See press release for more details.

6 June, 2013

Innofactor signed a contract to acquire the entire share capital of atBusiness Ltd.

See Stock Exchange Release for more details.

30 November, 2012

Innofactor signed a contract to acquire the Microsoft project and project portfolio management solutions business from Tietotalo Infocenter Ltd.

25 June, 2012

Innofactor signed a contract to acquire the entire share capital of Bridgeconsulting A/S.

See Stock Exchange Release for more details.

3 December, 2010

Westend ICT Plc and Innofactor Ltd merged to become the Innofactor Plc Group.

See Stock Exchange Release for more details.

3 June, 2010

Visual Management Ltd became part of Innofactor Software Ltd.

12 October, 2009

Innofactor Software Ltd acquired Software Innovation Finland Ltd.

1 April, 2007

Innofactor purchased the Enfo Ltd business unit responsible for electronic business solutions.

15 December, 2004

Innofactor Software Ltd acquired TietoEnator Plc's parish-software business.

Sustainability

Innofactor considers sustainability as one of the cornerstones of its long-term success. Sustainability is not only a condition for the continuation of operations. It also represents a way of responding to stakeholder expectations. Technology companies play a significant role in the mitigation of – and adaptation to – climate change. The IT sector also makes it possible for other organizations to reduce their carbon footprint.

Innofactor's operations are guided by our Code of Conduct and Environmental Policy, in addition to which we comply with the leading international sustainability standards, such as the ILO Declaration on Fundamental Principles and Rights at Work, the UN Universal Declaration of Human Rights, the UN Sustainable Development Goals, and the principles of the ICC Business Charter for Sustainable Development.

Innofactor's internal operations are managed through predefined core processes and standards. The key processes related to sustainability include the company's processes relating to legal affairs, risk management and human resources, which govern many of the main aspects of corporate responsibility. The framework for Innofactor's operations is provided by the ISO 9001, ISO 27001, ISO 13485 and AQAP-2110 standards, which the company's various processes adhere to.

Innofactor is committed to supporting the achievement of the UN Sustainable Development Goals (SDGs) by 2030. We have identified the most relevant SDGs from the perspective of our business operations: SDG 8 Decent work and economic growth, SDG 5 Gender equality, and SDG 3 Good health and well-being.

In autumn 2021, Innofactor signed the Microsoft Partner Pledge to commit to the development of digital skills, diversity, ethical AI and environmental responsibility.

Innofactor's sustainability strategy

Our sustainability vision is: We promote sustainable innovation, equality, well-being and integrity to build a better future.

Our sustainability strategy is divided into four areas:

- We innovate for good

- We are fair

- We put people first

- We build trust

The areas and objectives of the strategy are based on the results of our stakeholder survey and internal workshops, and approved by the Board of Directors. The sustainability strategy is aligned with Innofactor's strategy, mission, values, employee value proposition and working principles.

Future Outlook

Innofactor’s future outlook for 2025

Innofactor's business is expected to continue as normal in 2025. Innofactor is in redemption proceedings concerning all shares in the company. The redemption proceedings are expected to be completed during the financial year, and the company will not issue more detailed financial guidance for the financial year 2025.