Corporate Governance

As a Finnish public limited company, we comply with the Finnish Companies Act, other regulations concerning public companies, and our Articles of Association in our decision-making processes and administration.

As a Finnish public limited company, we comply with the Finnish Companies Act, other regulations concerning public companies, and our Articles of Association in our decision-making processes and administration.

Innofactor is a Finnish public limited company which, in its decision-making and administration, complies with the Finnish Companies Act, other regulations concerning public companies, and the company's Articles of Association.

Innofactor Plc complies with the recommendations of the Finnish Corporate Governance Code 2020 for listed companies, published by the Securities Market Association.

Additionally, Innofactor Plc complies with the Guidelines for Insiders drawn up by the Helsinki Exchange and follows a consistent communications policy.

Innofactor Plc's annual statement on Corporate Governance can be found at:

Corporate Governance Statement 2023.pdf

Corporate Governance Statement 2022.pdf

Corporate Governance Statement 2021.pdf

Corporate Governance Statement 2020.pdf

Corporate Governance Statement for the Financial Period 2019.pdf

Corporate Governance Statement for the Financial Period 2018.pdf

Corporate Governance Statement for the Financial Period 2017.pdf

Corporate Governance Statement for the Financial Period 2016.pdf

Corporate Governance Statement for the Financial Period 2015.pdf

Corporate Governance Statement for the Financial Period 2014.pdf

Corporate Governance Statement for the Financial Period 2013.pdf

Corporate Governance Statement for the Financial Period 2012.pdf

Corporate Governance Statement for the Financial Period 2011.pdf

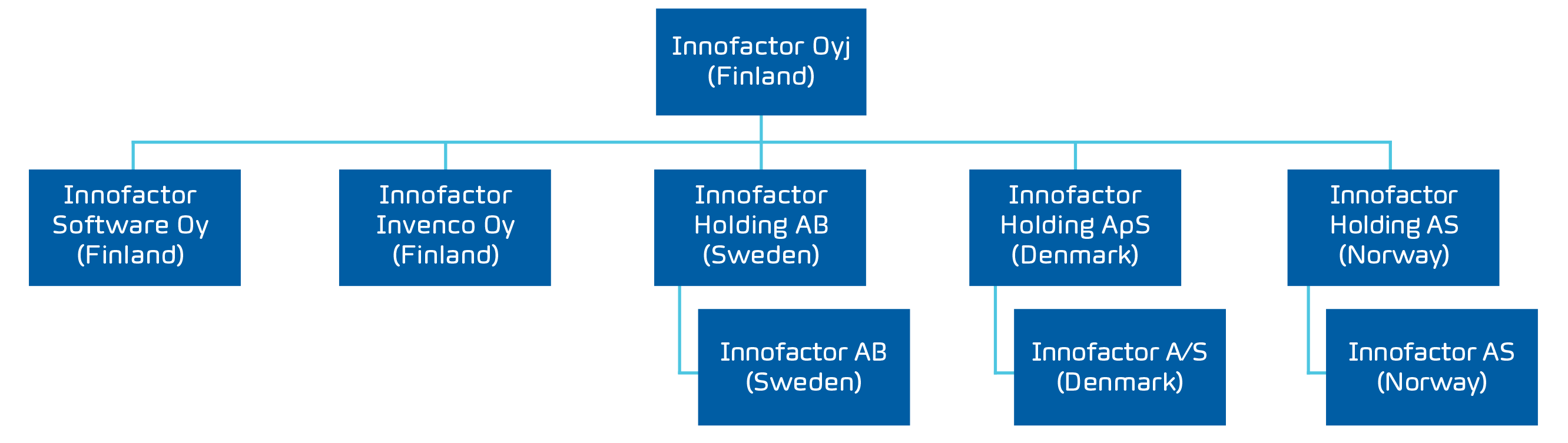

Innofactor Group includes the following companies:

The General Meeting is the highest decision-making body in Innofactor Plc. Convened by the Board of Directors, the General Meeting is held in Espoo, the company's domicile, or alternatively in Helsinki or Vantaa, in accordance with the Articles of Association.

According to the Articles of Association, Annual General Meetings shall be held annually within six months of the end of each fiscal year on a date specified by the Board of Directors. Extraordinary General Meetings shall be held when this is considered necessary by the Board of Directors, if the auditors make a request in writing to allow the handling of a specific subject, or if a request is made by shareholders holding a minimum of 10% of the total number of shares issued.

Invitations to General Meetings are published on the Innofactor Plc website and conform to the requirements set for such invitations in the Companies Act in all other respects.

An invitation to a General Meeting states the matter or matters to be handled and discussed at that meeting. If these matter include, among others, amendment of the company's Articles of Association, an increase or decrease in the company's capital stock, a decision regarding acquisition of the company's own shares, a decision on a merger or company division, or a decision regarding liquidation, the main substance of such matters must be specified and described in the invitation.

If a General Meeting is to handle, for example, the company's annual accounts, a report on a special audit, an increase or decrease in the company's capital stock, the granting of collateral security, taking out a convertible loan, acquiring the company's own shares or a decision concerning a merger, company division or liquidation, documents relating to the matter or copies thereof are made available to shareholders at the Innofactor Plc head office for a period of one week prior to the date of the meeting and are sent to any shareholder who requests them.

In accordance with the Companies Act and Innofactor Plc's Articles of Association, Annual General Meetings must decide on at least the following matters:

The Annual General Meeting elects the members and any possible deputy members of the Board of Directors, an auditor, and if needed, a deputy auditor. The Annual General Meeting also elects the Chairman for the Annual General Meeting.

All shares in Innofactor Plc entitle their holders to equal rights in the company (an equal say in the company's affairs). Shareholders exercise their right to make decisions concerning the company at a General Meeting.

Shareholders may exercise their rights at a General Meeting either in person or through a representative. Representatives must present a dated proxy. Shareholders or their representatives have the right to bring an assistant to General Meetings.

Everyone attending a General Meeting has the right to exercise all the voting rights attached to the shares they represent. On the other hand, shareholders or their representatives may not vote in matters relating to the granting of a discharge to that shareholder, any action being taken against them, their discharge from liability or any other obligation towards the company. Also, shareholders may not vote in matters that relate to an action against another person or their discharge from liability if the shareholder concerned would gain material benefit that could be in conflict with the company's interests.

Shareholders are entitled to have a matter of their choice handled at a General Meeting if they present the Board of Directors with a written request to this effect and there is sufficient time before the General Meeting.

Shareholders have the right to obtain additional information at a General Meeting by presenting questions concerning the state of the company to the Board of Directors or the CEO. The right to ask questions is limited to issues that could affect Innofactor Plc's financial statements, financial status, or other matters being discussed in (on the agenda of the General Meeting. Questions of this nature must be asked by shareholders while the issue to which their question or questions relate is being discussed. The Board of Directors or the CEO is responsible for providing (has a duty to provide ???) a shareholder with more detailed information provided that that this can be done without causing the company substantial harm. The Board of Directors is responsible for deciding whether such an answer can be given without causing substantial harm to the company. If a question raised by a shareholder cannot be answered using information available at the meeting, a written answer will be provided within two weeks. The document containing the answer will be sent to the shareholder who raised the question and will also be made available at the company's head office.

The Innofactor Plc share register and register of shareholders are maintained by Euroclear Finland Oy (formerly Suomen Arvopaperikeskus Oy) and access to these documents is not restricted. Copies of the share register and shareholder register can be obtained against payment of a small fee to cover the cost of duplication.

Innofactor Plc has a Board of Directors comprising at a minimum of four (4) and at a maximum of eight (8) members. The current Board of Directors has four (4) members.

Members and deputy members of the Board of Directors are elected by the Annual General Meeting. Members serve a term which ends at the conclusion of the following Annual General Meeting unless a decision is made by an Extraordinary General Meeting to makes changes to the Board of Directors before this date.

Members of the Board of Directors may resign before their term of service ends. The Board of Directors must be notified of any premature resignation. A General Meeting can dismiss a member of the company's Board of Directors.

If the position of a member of the Board of Directors becomes vacant during a term of service and there is no deputy member, the remaining members of the Board of Directors have a duty to ensure that a new member is elected by the General Meeting for the remainder of that term. If the Board of Directors with its remaining members and deputy members is quorate, such election may be postponed until the following General Meeting, at which members of the Board of Directors would then be elected.

The work of the Board of Directors, including the making of decisions, takes place at Board meetings, and these are held approximately once a month in accordance with the Board of Directors' meeting plan. Practical aspects connected with Board meetings are described in greater detail in the Board of Directors' rules of procedure.

Responsibilities of the Board of Directors are based on the Finnish Companies Act and defined in Innofactor Plc's Articles of Association. The Board of Directors has general authority to decide and act in all matters not reserved for other corporate governing bodies by the Finnish Companies Act or the company's Articles of Association. The Board of Directors is responsible for organising the company in an effective manner and monitoring the company's management in accordance with the best interests of the company and its shareholders. Responsibilities of the Board of Directors and its members are described in greater detail in the rules of procedure for the Board of Directors.

The Board of Directors assesses its operations and working procedures on a regular basis by carrying out a self-assessment once a year.

Information regarding Innofactor Plc's operations is supplied to the Board of Directors in a timely manner and in a form and quality which enables the Board to discharge its duties. To ensure that the Board of Directors has appropriate financial information, the Board has access to the minutes of Executive Board meetings, including a financial report in accordance with the company's instructions.

In matters of importance to Innofactor Plc, if necessary, individual Board members have the right to seek information and advice from independent sources with the cost of such enquiries being met by the company.

The fees and other benefits of the Board of Directors are presented in the Remuneration Statement for the Financial Period.

Anna Lindén, born in 1973, M. Pol.Sc.

Anna Lindén, born in 1973, M. Pol.Sc.

Chairman of the Board of Directors as of March 31, 2020 and member of the Board of Directors as of April 4, 2018. Ms. Lindén has extensive background in business leadership and information technology. She has worked e.g. as COO for Nokia’s Mobile Networks Business Group, and in many other global leadership positions at Nokia, as well as managed a business unit on the leadership team of a listed company. Ms. Lindén has strong know-how of management in a multi-national company as well as of taking technology changes into account in business. Currently she also is Vice Chairman of the Board of Directors of Åbo Akademi University. LinkedIn

Sami Ensio, born in 1971, M.Sc. (Tech.)

Mr. Ensio has been Innofactor Plc's CEO since December 27, 2010, and before that, he was the founder and CEO of Innofactor Ltd starting from January 1, 2000. He has been a member of Innofactor Plc's Board of Directors since 2010, and before that, he was a member of the Innofactor Ltd's Board of Directors starting from 2000. Mr. Ensio holds several positions of trust in the Federation of Finnish Technology Industries and the Confederation of Finnish Industries. For example, he is a Member of the Board in the Federation of Finnish Technology Industries and Vice Chairman of the Confederation of Finnish Industries' Executive Committee, Delegation of Entrepreneurs. Mr. Ensio has an extensive understanding of IT business in the Nordic Countries and of the Microsoft ecosystem. LinkedIn

Risto Linturi, born in 1957, M.Sc. (Tech.)

Mr. Linturi has been a member of the Innofactor Plc's Board of Directors as of 2018 and acted in Innofactor Ltd's Board of Directors in 2000–2010. He currently works as an independent consultant through his family business, R. Linturi Plc. In 2004–2014, Mr. Linturi was the program director of Aalto University's Radical innovations program. Previously, he has been, for example, the technology director of Helsingin Puhelin (current Elisa Oyj) and President of the IT training company operating under his name (current Tieturi Oy). Mr. Linturi has also held several other Board memberships. Mr. Linturi's area of specialization is understanding the economic and societal effects of new and upcoming technologies. He is one of Finland's most prominent futurists and has drawn up reports, for example, for the Finnish Parliament. Mr. Linturi is independent of the company and its main shareholders. LinkedIn

Heikki Nikku, born in 1956, B.B.A. (Not finished)

Heikki Nikku, born in 1956, B.B.A. (Not finished)

Member of the Board of Directors as of March 31, 2020. Mr. Nikku has more than 30 years of experience in the information technology industry. He has a wide range of experience in business and operational management as well as a proven sales and marketing track record. His most recent position was the President of CGI, Northern Europe Operations, in 2017-2019, leading an organization of 10,000 members. Mr. Nikku started at CGI in 2012 as BU Leader and Country Manager in Finland and Estonia, after which he led CGI’s operations in the Nordic countries, Lithuania and Estonia in 2015-2017. Previously, Mr. Nikku held the Country Manager position at Logica Finland in 2008-2012. He has also held several Board memberships. Mr. Nikku is a successful business leader and has achieved great operational results in the Northern European market. Thanks to his experience, he is very knowledgeable about IT industry trends, especially in Innofactor’s area of operation in the Nordic countries. LinkedIn

Anna Lindén, Board Chairman, Innofactor Plc: Ownership: 121,851 shares.

Sami Ensio, Board Member, Innofactor Plc: Ownership: 5,751,637 shares.

Risto Linturi, Board Member, Innofactor Plc: Ownership: 337,304 shares.

Heikki Nikku, Board Member, Innofactor Plc: Ownership: 41,488 shares.

Innofactor Plc does not currently have an incentive programme under which members of the Board of Directors are rewarded by the allocation of company shares.

Anna Lindén, Board Chairman, Innofactor Plc, is independent of the company and its main shareholders.

Sami Ensio, Board Member, Innofactor Plc, is not independent of the company as he is the CEO and a significant shareholder of the company (15.30% ownership).

Risto Linturi, Board Member, Innofactor Plc, is independent of the company and its main shareholders.

Heikki Nikku, Board Member, Innofactor Plc, is independent of the company and its main shareholders.

The Board of Directors of Innofactor Plc has in its meeting of 2 May 2017 established a Remuneration Committee.

The Board of Directors has not set up any other Board committees.

The tasks and responsibilities of the Board of Directors are based on the Companies Act, Securities Market Act, other laws, Articles of Association, Corporate Governance for Finnish listed companies published by the Securities Market Association, NASDAQ Helsinki exchange's rules for communications and insider management, and the rules of procedure for the Board of Directors.

These rules of procedure were approved by the company's Board of Directors on May 2, 2017. The Board of Directors will update and change the rules as required.

In accordance with the Articles of Association, the company has a Board of Directors, which comprises at a minimum of four (4) and at a maximum of eight (8) members.

The Annual General Meeting elects the members for the Board of Directors. The term of the members ends at the end of the following Annual General Meeting, unless an Extraordinary General Meeting decides to change the Board of Directors before that. A member of the Board of Directors may resign from the task before the end of his/her term. The Board of Directors must be notified of the premature resignation. The General Meeting can dismiss a member of the Board of Directors. If the position of a member of the Board of Directors becomes vacant during the term and there is no deputy member, it is the duty of the remaining members of the Board of Directors to ensure that a new member is elected for the remainder of the term by the General Meeting. If the Board of Directors with its remaining members and deputy members has a quorum, the election may be postponed to the following General Meeting, in which the members of the Board of Directors would be elected in any case.

The Board members elect one of them as a Chairman for a term of one year. The tasks of the Chairman are described in section 6. No deputy chairman has been elected for the Board of Directors as it has been agreed on that the CEO will act as a deputy when the Chairman is absent.

The Board of Directors can name an outsider as a secretary or select a Board member as the secretary. The tasks of the secretary are described in section 7. Unless otherwise agreed on, the CEO will act as the secretary of the Board.

The Board of Directors of Innofactor Plc has in its meeting of 2 May 2017 established a Remuneration Committee from among its members. The Rules of procedure of the Committee is confirmed by the Board of Directors. The Board of Directors is responsible for the duties assigned to the Committee, and the Committee does not make independent decisions. The matters discussed by the Committee and the minutes of the meetings are presented to the Board of Directors, and the Committee reports to the Board at least two (2) times a year.

The Board of Directors has not set up any other Board committees.

The CEO explains the company's and group's business operations to the new Board members as soon after the selection as possible. As part of familiarizing the Board members, the company arranges training on securities market law and company law and other regulations concerning the company's operation as necessary.

The Board of Directors assesses the independence of its members as required and makes sure that any lack of impartiality is assessed when necessary.

Responsibilities of the Board of Directors and its members are based on the Companies Act and the company's Articles of Association. The Board of Directors has general authority to decide and act in all such matters that are not reserved by the Companies Act or Articles of Association to other corporate governing bodies. The Board of Directors is responsible for the effective organizing of the company and the monitoring of the management of the company according to the best interests of the company and its shareholders.

The main responsibilities of the Board of Directors are as follows:

The general responsibility of the Chairman of the Board is to lead the Board's work in such a manner that its responsibilities are carried out as efficiently and appropriately as possible. In this function, the Chairman's duty is

to ensure that the Board of Directors is operational and has a quorum;

to monitor the CEO's work and oversee that the CEO is able to perform his/her tasks;

The Chairman of the Board also approves the compensations paid by the company to the Board members for the expenses related to their work in the Board of Directors. The CEO approves the compensation paid by the company to the Chairman of the Board for the expenses related to the work in the Board of Directors.

The general responsibility of the Board secretary is to support the Chairman's work in such a manner that it is carried out as efficiently and appropriately as possible. In this function, the secretary's duties are:

The Board of Directors makes its decisions in Board meetings.

The Board of Directors meets according to a predefined schedule approximately once a month and, if necessary, arranges additional meetings, which may also be held via conference calls.

For its operation, the Board of Directors draws up a meeting calendar.

The Chairman of the Board is responsible for convening the meetings. The CEO, together with the Chairman of the Board and with the help of the secretary, takes care of preparing the agenda for a Board meeting. The Board secretary must be notified five business days before the meeting on any issues that are to be dealt with in the meeting.

An invitation to the meeting and materials for the meeting are delivered electronically in such a manner that the Board members receive them at least two days before the meeting or, whenever possible, the materials for the meeting are delivered to the Board members by 15:00 on the Friday before the meeting.

The invitation includes the agenda, the minutes of the previous Board meeting, the latest monthly financial report, and other possible documents related to the handling of issues on the agenda.

The materials for the meeting and other confidential material relating to the company are not to be sent through unsecured email, unless it is absolutely necessary.

The Chairman of the Board, or if he/she is absent, the CEO, acts as the chairman in the Board meetings.

The Board of Directors handles the issues listed in the agenda of the meeting. In addition to the issues based on these rules of procedure, the Board meeting handles as standard issues the approval and signing of the minutes of the previous meeting, the financial review, and the CEO's situation review.

Other issues than those in the agenda may be handled on the initiative of either a Board member or the CEO. A decision on other issues can be made only, if all Board members accept it.

In addition to the Board members, the CEO, CFO (during issues concerning the financial reporting) and Board secretary are present in the meetings. An issue is presented to the Board of Directors by the CEO or some other person to whom the CEO, with the Board's approval, has delegated the making of the presentation.

The CEO has the right to be present in the meetings and the right to be heard, unless otherwise decided by the Board of Directors in a specific case. The auditor has the right to be present and the right to be heard at the Board meetings in which issues related to the auditor's tasks are discussed. If necessary, the Board of Directors discusses the company and its development without the operating management being present.

The Board of Directors has a quorum when over half of the Board members are present. Decisions are made by simple majority of votes. All Board members must be reserved an opportunity to participate in the handling of an issue, if possible, in order to ensure that the decision of the Board of Directors is made in an appropriate manner. If the votes are divided equally, the Chairman's vote decides.

If a Board member disagrees with a decision of the Board of Directors, he/she may state a dissenting opinion to be registered to the minutes of the meeting. The dissenting opinion must be stated immediately after the decision has been made.

A Board member or the CEO may not participate in the handling of a contract between him/herself and the company or in the handling of a contract between the company and a third party, if he/she may thereby receive a material benefit, which may be in contradiction with the interest of the company or which is related to a company or other organization in which he/she is a member of the operating management or governing body. The Board of Directors is responsible for taking any lack of impartiality into consideration when necessary. A Board member must also always assess and consider the need for recusing him/herself.

If a Board member is unable to attend, his/her deputy (if one has been elected) must be reserved the same opportunity to participate in handling the issue.

A quorum requires that the invitation has been delivered to all Board members in an appropriate manner. Any inadequacies in the invitation are considered corrected, if all Board members are present in the meeting or if the Board members afterwards accept the decisions, for example, by signing the minutes of meeting.

Minutes of meeting with consecutive numbering according to the calendar year are drawn up for the Board meetings. The minutes of meeting must state the time and location of the meeting and the names of Board members present. The Chairman of the Board is responsible for maintaining the minutes of meeting. A person named by the Board of Directors acts as the Board secretary.

The minutes of meeting are kept in the form of a final protocol. For important issues, also the main grounds for the decision are entered into the minutes of meeting or an attachment thereof. Any dissenting opinions, votes and Board member's incompetence due to the likelihood of bias are entered into the minutes of meeting.

All Board members sign the minutes of meeting. The minutes of meeting for a phone meeting are signed by all Board members who took part in handling the issue.

The minutes of meeting without attachments are delivered to the Board members after each meeting when the Chairman of the Board and the CEO have approved the minutes. The goal is to deliver the minutes of meeting within five business days after the meeting. The minutes of meeting will be approved in the next meeting.

The minutes of meeting will be stored at the head office of the company for as long as the company shall exist.

The Board of Directors has access to the minutes of Executive Board meetings.

It is the CEO's responsibility to keep the Chairman of the Board well informed of the company's daily situation.

The CEO also has the responsibility to inform the company's Board of Directors on his/her own initiative about important matters concerning the company's operation, such as development of sales, significant changes in liquidity and bearing, substantial credit losses, and significant purchases or other contracts.

If necessary, in matters of importance for the company, individual Board members have the right, at the cost of the company, to seek information and advice from independent sources.

The Board of Directors must assess its operation and working methods annually. The assessment is carried out as an internal self-assessment.

The purpose of the assessment is to find out how the operation of the Board of Directors has been carried out and how it can be developed.

The Remuneration Committee makes proposals to the Board of Directors in respect of remunerations of the company's CEO and other executives of the Group as well as on the principles and practices of the employee remunerations. The Remuneration Committee observes and evaluates the competitiveness of the incentive and compensation plans of the Group.

All the members of the Remuneration Committee are independent of the company and its significant shareholders. When electing the members of the Remuneration Committee, the competence requirements applicable to the members have been taken into account.

The Committee convenes regularly, at least two times a year. The Committee's operations and key duties are described in the rules of procedure below.

Innofactor Plc's Remuneration Committee assists the company's Board of Directors by preparing matters that belong to the Board's duties, fall within the scope of the Committee's operations, and are defined in these rules of procedure. The Committee does not make independent decisions.

The Board of Directors elects the Committee Chairman and members from among the Board members. The minimum number of Committee members is three (3) and the members must be independent.

In cooperation with the company's CFO, the Chairman prepares the matters to be discussed and advance materials for the meetings that are delivered by e-mail to the members of the Committee at the latest one day before the meeting.

The Remuneration Committee convenes during the calendar year at the invitation of the Chairman, and there are at least two (2) meetings a year.

The company's CFO acts as the presenter for the Committee. The company's General Counsel acts as the Committee's Secretary. By the Chairman's decision, the Committee may also allow other persons to participate in the meeting.

The minutes are prepared by the Secretary and confirmed by the signatures of the Chairman and the Secretary.

The matters discussed by the Committee and the meeting minutes are presented to the Board of Directors.

The Committee and the Board of Directors evaluate the Committee's work annually in connection with the Board's self-evaluation.

The Remuneration Committee makes proposals to the Board of Directors in respect of remunerations of the company's CEO and other executives of the Group as well as on the principles and practices of the employee remunerations. The Remuneration Committee observes and evaluates the competitiveness of the incentive and compensation plans of the Group.

The Committee prepares the following matters for the Board of Directors' decision making:

1. Innofactor's remuneration policy and remuneration report for governing bodies

2. Innofactor Plc's CEO's salary, pension terms and conditions, benefits, and other key terms and conditions of the service contract;

3. other Group executives' salary, pension terms and conditions as well as benefits, including the management's compensation plan;

4. share-based compensation plans; and

5. principles and practices of the employee remunerations.

Innofactor Plc's Chief Executive Officer (CEO) is appointed by the Board of Directors.

The CEO is responsible for day-to-day management of Innofactor Plc, which consists of managing and controlling the company's business in accordance with decisions and instructions issued by the Board of Directors.

The CEO may not engage in unusual or extensive actions without receiving specific approval for such activity from the Board of Directors, except in situations where failure to carry out such actions would result in significant damage to Innofactor Plc's operations and the approval of the Board of Directors cannot be obtained in time. The Board of Directors must be notified immediately of any actions taken without waiting for the Board's approval).

The main responsibilities of the CEO are:

Even if the CEO is not a member of the Board of Directors, he/she has the right to be present and to be heard in the Board meetings, unless otherwise decided by the Board of Directors in a specific case.

The CEO may not participate in the handling of a contract between him/herself and the company or in the handling of an issue between the company and a third party, if he/she may thereby receive a material benefit, which may be in contradiction with the interest of the company.

Decisions on fees paid to the CEO and other possible rewards are made by the Board of Directors on an annual basis. Such fees and the CEO's terms of employment are described in the section concerning compensations.

Sami Ensio, born 1971, M.Sc. (Tech.)

Mr. Sami Ensio founded Innofactor in 2000 and has been since then the CEO and Member of the Board of the company. He is the main shareholder of the company with about 21% ownership.

Ensio’s ambition is to innovate making the world work better, to drive the modern digital organization and to create the leading digital transformation partner in the Nordic Countries. He has built Innofactor from a one-man company to 500+ employees and Nasdaq listed company in 20+ years. He has 25+ years’ experience as a trusted ICT advisor for several customers. His specialties include solid and comprehensive know-how of the software industry as well as strategic and operational leadership and managing profitable growth.

Ensio holds several positions of trust in the Federation of Finnish Technology Industries, e.g. Vice Chairman of the Board, and Confederation of Finnish Industries, e.g. Member of Board. He was selected Software Entrepreneur of the year by the Finnish Software Entrepreneurs Association in 2011 and Knight First Class of the Order of the Lion of Finland, issued The President of the Republic of Finland, in 2020. Ensio has been a member of the Microsoft Corporation's global Partner Advisory Council from 2014 to 2020.

Ensio has Master of Science (Technology), Technical Physics degree, Helsinki University of Technology (Aalto University), legal studies at the University of Helsinki, and general business studies at University of California, Los Angeles UCLA. More information on LinkedIn.

CEO Sami Ensio's ownership with related parties is 7,925,397 shares. Together with his under-age children, Ensio is the largest individual stakeholder (21.81% ownership).

Decisions by the Innofactor Plc Executive Board are made at Executive Board meetings which are convened in accordance with a meeting programme drawn up by the Executive Board in advance.

The Executive Board is quorate when the CEO is present. If decisions by the Executive Board are not unanimous, decisions to which the CEO gives his/her support will taken as final. Additional information on the handling of matters at Executive Board meetings is provided in the Executive Board's rules of procedure.

The Executive Board's responsibilities include:

Decisions on fees paid to the Executive Group and other rewards are made by the Board of Directors on an annual basis. Principles underlying rewards for members of the Executive Board are described in the compensations section.

Sami Ensio, b. 1971, M.Sc. (Tech.)

President and CEO, Country Manager Finland

CEO of Innofactor Plc since December 27, 2010. Previously the founder and CEO of Innofactor Ltd since January 1, 2000. Member of Innofactor Plc's Board of Directors since 2010 (member of Innofactor Ltd's Board of Directors since 2000). Member of Microsoft Corporation's Partner Advisory Council from 2014 to 2020. Several positions of trust in the Federation of Finnish Technology Industries and the Confederation of Finnish Industries since 2013. For example, he is a Member of the Board in the Federation of Finnish Technology Industries and Vice Chairman of the Confederation of Finnish Industries' Executive Committee, Delegation of Entrepreneurs. In 2021, he acts as a Vice Chairman of the Board in Technology Industries of Finland, and a Member of the Board in the Confederation of Finnish Industries. LinkedIn

Jørn Ellefsen, b. 1971, MBA

Managing Director, Country Manager, Innofactor Norway and Innofactor Denmark

Managing Director, Country Manager in Norway since March, 2019 and Managing Director, Country Manager in Denmark since January, 2020. Proven track record of success spanning over 25 years in the ICT industry in Norway in key management roles at Oracle and Computas, and most recently as Sales Director and VP Insight at Acando Norway. At the company, also managed the Microsoft Alliance, built up a new business area on Microsoft Analytics, and successfully grew the Dynamics CRM business during the integration of the two units. Business founder of StairPoint – a provider of secure and automated collaboration solutions. Also, co-founded and led the growth of Comperio, which under him became a leading solution partner across five countries and awarded Microsoft Partner of the Year within Enterprise Search. LinkedIn

Martin Söderlind, b. 1971, B.Sc. (not finished)

Martin Söderlind, b. 1971, B.Sc. (not finished)

Managing Director, Country Manager, Sweden

At Innofactor since April 1, 2021. More than 20 years of business development, leadership and international experience within the ICT industry. Prior to joining Innofactor, held the position of COO Scandinavia at Nordcloud with focus on growth in Sweden, Denmark and Norway. Before this, held a number of leadership and business development positions within Telia Company. LinkedIn

Antti Rokala, b. 1968, M Sc. (Econ)

Antti Rokala, b. 1968, M Sc. (Econ)

CFO

Innofactor's Chief Financial Officer since January 2024. Rokala has over 25 years of experience in various leadership roles in international companies. Previously, Rokala has served as the Chief Financial Officer of the education company YrkesAkademin Group in Stockholm, as well as in various financial management and leadership positions at Schindler, including the role of Nordic Chief Financial Officer. LinkedIn.

Janne Heikkinen, b. 1974, M.Sc. (Tech.)

Executive Vice President, Products and Services

At Innofactor since 2015. In charge of Products and Services Unit. Before joining Innofactor, worked for Microsoft in the global organization where his last position was Head of Product Management, Surface, based in San Diego. Also worked at Nokia for 14 years and has held several roles in the product management and marketing for devices, SW and services. Moreover, worked at Nokia in technology strategies, business analysis and development roles. LinkedIn

Vesa Syrjäkari, b. 1960, M.Sc.

Executive Vice President, Business Development and Operational Excellence

Executive Vice President, Business Development and Operational Excellence since 2017. Focuses on improving profitability and ensures that the already made plans for improving effectiveness in business units are implemented successfully. Has been one of the highest-ranking Finns ever in the Microsoft's international organization and his last job there was to be responsible globally for the effectiveness of Microsoft's sales to its major customers. LinkedIn

Anni Wahlroos, b. 1988, M.Sc.

Chief People Officer

Has worked in several HR-roles at Innofactor since July 2015. Most recently, Wahlroos held the position of HR Director, Nordic Development & Operations, and HR Director, Finland. In her current position, Anni continues to lead Innofactor's Finnish HR. LinkedIn

As of July 3, 2016 Innofactor has published all transactions by managers by stock exchange release in line with the MAR. The releases can be found in Transactions of Managers section.

Sami Ensio, President and CEO. Ownership and controlled shares jointly 7,925,397.

Jørn Ellefsen, Managing Director, Country Manager, Innofactor Norway and Innofactor Denmark. Ownership: 93,999 shares.

Martin Söderlind, Managing Director, Country Manager, Sweden. Ownership: 10,000 shares.

Janne Heikkinen, Executive Vice President, Products and Services. Ownership: 136,543 shares.

Antti Rokala, Chief Financial Officer. Ownership: 10,000 shares.

Vesa Syrjäkari, Executive Vice President, Business Development and Operational Excellence. Ownership: 0 shares.

Anni Wahlroos, Chief People Officer, 32,296 shares.

The Board members for Innofactor Plc's Finnish subsidiaries are the Group CEO and President Sami Ensio (Chairman) and Chief People Officer Anni Wahlroos. General Counsel Eija Theis is a deputy member.

The Board members for Innofactor Plc's Swedish, Danish and Norwegian holding companies are the Group CEO and President Sami Ensio (Chairman) and Chief People Officer Anni Wahlroos. In addition to that, General Counsel Eija Theis is a board member in the Danish holding company, and a deputy member in the Swedish holding company.

In the boards of directors of Innofactor Plc's Swedish, Danish, and Norwegian operational country companies, the CEO and President of the Group, Sami Ensio, serves as the chairman, and the Chief People Officer, Anni Wahlroos, is a board member. In addition to that, General Counsel Eija Theis is a board member in the Danish operational company, and a deputy member in the Swedish operational company. Additionally, the local CEOs of Sweden and Norway serve on the boards of directors of the operational companies of those countries based on their positions.

The Corporate Governance for Finnish listed companies requires that Innofactor Plc publishes information concerning its reward system on the company's website and publishes an annual report on salaries paid and other forms of compensation awarded. Remuneration reports for the financial periods can be found in the end of this page.

According to the Remuneration Policy, the members of the Board of Directors are paid an annual fee and a possible meeting fee. The Annual General Meeting decides on the remuneration of the members of the Board of Directors. The Chairman of the Board, a possible Deputy Chairman and members of any committees may be paid an increased fee or meeting fees. Remuneration paid to the members of the Board of Directors may be paid in cash or in part or in full in the form of the Company's shares.

In 2023, the Annual General Meeting decided that the remuneration of the Chairman of the Board of Directors is EUR 60,000 per year and the remuneration of the other members of the Board of Directors is EUR 30,000 per year. Half (50%) of the fee will be paid in cash and half (50%) in Innofactor Plc shares. The shares shall be handed over to the members of the Board of Directors during April primarily from shares in the Company's possession or, secondarily the shares shall be acquired from public trading directly on behalf of the members of the Board of Directors within two weeks of publishing the interim report of Innofactor Plc for January 1 – March 31, 2023. In case shares will not be acquired due to a reason arising from the Company or the Board member, the entire fee will be paid in cash. Innofactor Plc requires that the members of the Board of Directors retain the shares received as a reward for the duration of their Board membership.

Remuneration paid to members of the Board of Directors in 2023

| Member of the Board of Directors | Annual fee in cash/shares | Total remuneration |

| Sami Ensio | 15,000 / 15,000 | 30,000 |

| Anna Lindén (puheenjohtaja) | 30,000 / 30,000 | 60,000 |

| Risto Linturi | 30,000 / 0 | 30,000 |

| Heikki Nikku | 15,000 / 15,000 | 30,000 |

No other financial benefits have been paid to other members of the Board of Directors. In his position as the Company’s CEO, Sami Ensio has been paid the salaries and remuneration reported in the next section.

The Company's Board of Directors decides on the remuneration of the CEO within the framework of the Remuneration Policy. The Company's Remuneration Committee prepares proposals for the Board of Directors concerning the decisions on the CEO's remuneration. The CEO's remuneration consists of a fixed share and variable shares. The fixed part is the CEO's annual salary and fringe benefits. Variable components of the CEO's remuneration can be, for example, short-term and long-term incentives. In addition, the CEO's remuneration may consist of other benefits, such as insurance, severance pay and voluntary retirement benefits.

The CEO's total remuneration depends on the Company's performance in relation to the targets set for the Company. Innofactor's goal for the CEO's remuneration is that the variable proportions of the CEO's remuneration are approximately 0–50% of the CEO's possible maximum total remuneration, which does not include any possible Board remuneration or any benefit from the share issue to management and employees.

Innofactor's CEO's remuneration in 2023 was 345,165 euros in total. The fixed salary's proportion was 95% and the variable component's 5%. The remuneration paid to the CEO in 2023 is depicted below.

Components of the CEO’s remuneration

| CEO | Paid in 2023 | Performance bonus for 2023 (paid in 2024) |

| Salary | 327,929 | |

| Performance bonus | 17,236 | 33,849 |

| Relative share of fixed and variable components % | 95/5 | |

| Total salary* | 345,165 |

*Does not include the remuneration paid for Board work

No other remuneration or benefits have been paid to the CEO.

The incentive-based remuneration of the CEO is based on the Company's financial, profit or other performance, the performance criteria of which are decided annually by the Company's Board of Directors. The incentive-based remuneration for the years 2023 and 2024 has been set to a maximum of 100% of the annual base salary. For 2023, the Board of Directors set the growth of the Company's net sales (weight 100%), which will additionally be multiplied by a profitability multiplier, as the indicators on which the CEO's performance bonus was based. In addition, the performance bonus is affected by the Company's employment and customer satisfaction. The Board of Directors has also decided that the performance bonus for 2023 can be increased by 20% if the Board of Directors decides on a personnel share issue in connection with the payment of the performance bonus and a person eligible for the bonus uses the bonus payment to participate in the share issue. The Board of Directors decided to pay the CEO's performance bonus for 2023 in accordance with a predetermined formula.

Also for 2024, the Board of Directors has set the growth of the Company's net sales (weight 100%), which will additionally be multiplied by a profitability multiplier, as the indicator on which the CEO's performance bonus will be based. The performance bonus will additionally be impacted by the Company's employee and customer satisfaction.

Innofactor's executive remuneration system is designed to promote the Company's long-term financial success and the favourable development of shareholder value. Executive remuneration consists of a fixed component including a monthly salary and fringe benefits, as well as a short-term incentive plan, the earning criteria of which are set annually by Innofactor's Board of Directors. Innofactor's Remuneration Committee prepares decisions on executive remuneration. Innofactor's Board of Directors decides the remuneration of the Executive Board.

The Executive Board members are paid a fixed total salary, which includes the monetary salary and fringe benefits. In addition, the members of the Executive Board are entitled to a result-based bonus defined by the Board of Directors annually. The earning period for the result-based bonus is a calendar year. The maximum amount of the bonus for a member of the Executive Board can equal to 80 percent of the annual total of the fixed salary. The bonus is based on the growth of the company’s net sales and profitability, which affect significantly the long-term economic success of the company. The said indicators are part of Innofactor Plc’s strategic Key Performance Indicators (KPI). Only business profit can be used for paying the bonuses.

In 2022, the Executive Board was paid a total of EUR 1,143,860 in fixed annual salary and EUR 90,630 in result-based bonus (applies to 2021).

The Executive Board members have the lunch benefit, health care in accordance with the company policy, mobile phone benefit, health insurance, life insurance, and no other fringe benefits.

The mutual term of notice of the Executive Board members is 3-6 months, depending on the contract. If the company terminates the contract with an Executive Board member, no compensation for the termination will be paid.

The Executive Board members’ retirement age and the basis for calculating the pension comply with the effective Employee Pensions Act. The Executive Board has no additional pension system.

The auditing fee is paid according to a reasonable invoice.

The Remuneration policy of Innofactor Plc can be found here.

Remuneration Policy of Innofactor Plc.pdf

Further details concerning salaries and compensation paid by Innofactor Plc can be found at:

Remuneration Statement for the Financial Period 2019.pdf

Remuneration Statement for the Financial Period 2018.pdf

Remuneration Statement for the Financial Period 2017.pdf

Remuneration Statement for the Financial Period 2016.pdf

Statement on Salaries and Fees for the Financial Period 2015.pdf

Statement on Salaries and Fees for the Financial Period 2014.pdf

Statement on Salaries and Fees for the Financial Period 2013.pdf

Statement on Salaries and Fees for the Financial Period 2012.pdf

Statement on Salaries and Fees for the Financial Period 2011

Innofactor complies with the EU Market Abuse Regulation (MAR), rules and guidelines of the Financial Supervisory Authority, and the Helsinki Stock Exchange's insider guidelines for listed companies.

Innofactor maintains a list, as required by the MAR, of persons discharging managerial responsibilities (managers) and their closely associated persons. These are required to inform the company and the Financial Supervisory Authority of their transactions involving company's financial instruments.

At Innofactor the members of the Board of Directors, the Managing Director and the members of the Executive Board of Innofactor Plc are considered managers in accordance with MAR.

Managers may not trade in the company's financial instruments during a 30-day closed window prior to the publication of the company's interim reports or financial statement releases, nor during insider projects.

The company maintains insider lists regarding all project-specific or event-specific insider information. The persons listed in the insider list may not trade in the company's securities for the duration of the project in question.

According to the company's internal rules, persons participating in the company's financial reporting may not trade during the 30-day closed window prior to the publication of the company's interim reports or annual financial statement releases.

Company executives should time their trading in financial instruments issued by the company so that the trading does not undermine confidence in the securities markets. It is recommended that company executives engage only in long-term investments using securities released by the company.

Coordination and monitoring of insider matters are the responsibility of Innofactor's General Counsel.

Innofactor has a notification channel for reporting suspected market abuse.

Innofactor Plc together with all its affiliates ("Innofactor") commits to be a reliable employer and business partner and thus requires all members of the organization to adhere to the standards set by this Code of Conduct. In addition to the Code of Conduct, Innofactor follows applicable laws, certain international standards and its binding obligations. Innofactor also requires that all its suppliers, subcontractors and partners commit to similar level of compliance.

Innofactor has an appropriate management system in place to enable adherence to this Code of Conduct.

Innofactor reserves the right to change and update this Code of Conduct.

All employees, directors (jointly hereinafter "Employees") and Board Members must recognize possible sources of conflicts of interest and take appropriate actions to avoid such conflicts and situations that may be deemed as conflicting by third parties. Any potential conflict of interest shall be properly disclosed by the person subject to it as soon as it arises.

Innofactor condemns all forms of corruption, including bribery and unlawful restriction of fair competition. Transparency and fairness in business practices are key, especially when co-operating with government officials. Conformity with anti-trust laws is enforced.

Employees shall withhold from conducting any acts affecting competition that would be deemed to be unethical.

Abuse of insider information is forbidden. We take our utmost to follow the EU Market Abuse Regulation and national insider guidelines and emphasize in all occasions that insider information must be kept strictly confidential and may not be disclosed to any non-insider within or outside Innofactor, including family members.

Innofactor Whistleblowing scheme exists to ensure that violations are caught and made notifications may be dealt with confidentiality.

Confidentiality and lawful processing of personal data must be respected. Confidential information shall be handled with care and vigilance, especially information regarding Innofactor's customers and business partners. Access to all confidential information must be limited.

All Employees are required to participate in information security trainings.

An accepting and welcoming work environment is essential for the well-being of our Employees. Innofactor offers each Employee equal opportunity to succeed and advance in their career regardless of gender, nationality, religion, race, age, disability, sexual orientation, political opinion, union membership, or social or ethnic origin. Employees are expected to act according to non-discrimination policies both within and outside the workplace.

Innofactor has a zero-tolerance policy regarding harassment and abuse. Employees are encouraged to report any disruptive behavior should they become aware of it.

Innofactor acts in accordance to treaties composed by the International Labor Organization and does not utilize child labor nor forced labor. We respect our Employees' right of association.

All Employees shall be paid a fair wage in accordance to the law and applicable collective bargaining agreements.

The health and safety of our Employees is a priority. We provide our Employees with safe working conditions and sufficient training to conduct their work with minimal hazard. Employee health is supported through promoting healthy living habits and offering occupational health care. We value lifelong learning and education and encourage our Employees' active participation to various courses and training programs.

Innofactor abides by the principles of sustainable development. Our environmental policy ensures that important environmental factors are considered in our daily functions, projects and further development.

Innofactor does not condone diversions from the Code of Conduct. Employees who fail to abide by the Code of Conduct shall be held accountable. Avenues for reporting violations are upheld.

Innofactor’s operations and finances involve risks that may be significant for the company and its share value. These risks are assessed by Innofactor Plc's Board of Directors four times a year as part of the strategy and business planning process. The risks are published in their entirety in the financial statement and in the Annual Report of the Board of Directors. The interim reports only present the changes in short-term risks.

The risks related to the operation of the Innofactor Group are primarily business risks related to the group companies that carry on its business operations.

Skilled personnel and its availability: The development of Innofactor's operations and deliveries depends greatly on the Group having skilled personnel and being able to replace persons, who are leaving, with properly skilled persons. In Innofactor's field of business, there is a lack of and competition for certain personnel resources, which may lead to short employment relationships and high personnel turnover. If Innofactor fails at motivating its personnel, keeping the personnel's skills on a high level and keeping the personnel in its service, that could cause problems for the Group's business operations. The success of the Group depends heavily on the employed personnel and their success in their work. Innofactor invests in the continuous development of its personnel and in high personnel satisfaction, a good employer image, efficient recruitment and, if necessary, the use of subcontracting

Increase in personnel costs: A majority of Innofactor's costs consists of salaries and other personnel costs (in 2023, about 68% of all costs, including depreciation). Currently, all of Innofactor's own employees work in the Nordic countries, whereas some competitors rely heavily on workforce in countries with cheap labor. If the personnel costs continue rising in the Nordic countries at the same rate as before, it will create a risk for Innofactor, if the prices paid for IT services will not rise correspondingly. Innofactor is monitoring the situation constantly and strives to affect the moderate development of personnel costs via interest groups. It also aims at increasing the share of work done by subcontractors and abroad, when it makes sense from the point of view of business operations, for example, in large product development projects.

Profitability of projects: A significant part of Innofactor's net sales is still derived from the project business. The profitable implementation of Innofactor's delivery projects requires that project calculation and planning before submitting a tender are done successfully as regards the amount of work and the delivery schedule, and also that the deliveries can be made in a cost-effective manner. It is possible that Innofactor fails at correctly estimating the profitability of a project and, thus, the delivery could cause losses to the company. Correspondingly, it is possible that projects may have to be sold cheaper because of competition, which leads to lower profit margins. Innofactor pays special attention to the profitability of project business and has included it as a central part of the monitored key performance indicators. The relative share of the project business has decreased and the company aims to decrease it further, which reduces the risks associated to project business.

Competition: Innofactor's main competitors are companies offering traditional information technology services and software in the Nordic countries. Some competitors have larger financial resources, wider product selection, cheaper workforce and larger existing customer base than Innofactor does and also notable legal resources, and they can use these when competing with Innofactor for the same deliveries. Additionally, new startup companies increase competition in certain deliveries. The price competition in the field is expected to remain intense. If the competition becomes tougher, it may have an adverse effect on Innofactor's business, operating result and financial position. Innofactor continuously strives to improve its competitiveness.

Research and product development: In Innofactor's operation, research and product development play a central role. In 2023, approximately 6.4 percent of net sales was used on research and product development. Each research and product development project carries the risk that the end results are not as successful financially as planned and that the investment in the project does not pay itself back. By constantly updating its offering and organizing its operations, Innofactor aims at minimizing the risks inherent in research and product development.

Changes in the technology and field of business: Fast development is characteristic for Innofactor's field of business. There can be quick changes in the customers' requirements and choices concerning software technology. The most significant ongoing change is the transition to making extensive use of artificial intelligence. If Innofactor cannot react to these changes, it may have an adverse effect on Innofactor's business, operating result and financial position. Innofactor strives to actively invest in new technologies and central areas of know-how and agree on customer deliveries in new areas. We have paid special attention to developing our offering related to artificial intelligence..

Information security and data protection: From the point of view of Innofactor's business, it is important to ensure adequate data security and data protection for customers. The realization of the risks relating to data security and data protection may lead to losses in net sales or penalties imposed by a supervisory authority. Innofactor has acknowledged the risks related to data security and data protection, on the basis of which the company has implemented standard-based data security and data protection management processes. Innofactor has a data security policy approved by the management, defining Innofactor's key data security objectives and means of implementation, as well as the organization of data security and related responsibilities. The data security policy is written in accordance with the ISO 27001 data security standard and legislation.

Compliance: It is important for Innofactor to comply with the laws and regulations applicable to Innofactor's business activities, and to conduct business ethically. Violations of laws and regulations may lead to administrative fines, penalties, criminal proceedings and liability, and claims for damages. The materialization of this risk may also have an adverse impact on Innofactor's reputation and lead to the loss of business opportunities. Innofactor has internal procedures and processes to ensure compliance in day-to-day business operations. Innofactor's Code of Conduct lays out ethical guidelines and standards for Innofactor and its subcontractors. Innofactor has an internal whistleblowing channel

Risk of a pandemic: An epidemic spreading into a global pandemic may hinder Innofactor's business operations. If there is no significant pandemic in Innofactor's operating area in the Nordic countries, the detriment will be limited mostly to a decrease in the availability of tools, especially computers, which are needed in Innofactor's business operations. If there is a significant pandemic also in Innofactor's operating area in the Nordic countries, it could mean introducing remote work, either for a part of or the entire personnel, a temporary decrease in customers' purchases, and delays in some customer deliveries, increasing absence rates connected directly to the disease caused by the pandemic, quarantine or mental symptoms caused indirectly by isolation and increased personnel turnover due to remote work.

Reaching the growth targets: Realizing the desired growth requires a growth rate that is clearly faster than the growth in the IT market in general. This has the risk that it cannot be realized in the future, although it has been done often in the past. Also, it is possible that the IT market in Innofactor's market area will not grow or may even shrink. Ensuring growth has a central part in planning Innofactor's operations and setting its goals. Innofactor strives to lessen this operational risk by focusing on the growing Microsoft solution areas, which grow faster than the IT market in general, and by focusing on sales to keep the order backlog on a sufficient level as regards the business operations.

Globalization: In accordance with its strategy, Innofactor seeks growth also in the global markets, outside of Finland, especially in the Nordic countries. Global operations typically always involve higher risks than operation at home. Innofactor strives to make sure that the investments in becoming a global player will not be so great that it would jeopardize the Group's ability to make profit and to grow. Additionally, the company strives to create a management model, common processes and systems that will decrease the risks in global operations.

Uncertainties and risks related to acquisitions: Innofactor's growth has been partially driven by acquisitions, and this may also be the case in the future. With acquisitions, there are uncertainties about finding suitable companies to acquire and in making the acquisitions at the desired price level and schedule. If acquisitions cannot be made as planned, the growth goal may be jeopardized. In acquisitions, Innofactor focuses on high-level know-how and good processes. Each acquisition, after it has been made, also carries some risks, which include the success of the integration, the stability of the key personnel, formation of the business value, and possible related needs for depreciations. Innofactor's strategy is primarily based on integrating the acquired companies in a fast schedule as part of the whole in the country in question. Innofactor invests in the integration process.

Success of the organizational changes: Rapid growth may occasionally require making significant changes in the organization. Starting a new organization typically includes challenges before the desired improvement in operation can be achieved. Typically, the operation can be at least restored to the previous level of efficiency within a few months from starting the new organization. If the improvement in operation for some parts does not take place within the planned schedule, there is a risk that it will not happen at all or that the delay may lead to extra costs or loss of net sales. The reasons for this include, for example, incorrect planning in placing units and personnel. Innofactor strives to pay attention to controlling organization changes and to prepare for them also financially.

General financial uncertainty and changes in the customers' financial situations affect customers' investment decisions and purchasing policies. It is possible that changes in the general financial situation will be reflected in Innofactor's customers' software purchases by delaying the decision-making or timing of purchases.

Financing risks: In its normal business operations, the Innofactor Group is susceptible to normal financing risks. At the end of 2023, Innofactor had a total of approximately EUR 4.5 million in loans from financial institutions and a credit limit of approximately EUR 5.0 million, of which approximately EUR 1.8 million was in use. Innofactor has committed to the following covenants: Equity ratio calculated every 6 months is at least of 40%, and interest bearing liabilities calculated every 6 months divided by the 12-month operating margin (EBITDA) is a maximum of 2.5, and certain other normal conditions for loans. The goal of managing the financing risks is to minimize the negative effects of the changes in the financial markets on the result of the Group. Financing risk management has been centralized to the CFO, who is responsible for the Group's financing and regularly reports to the company's Executive Board, CEO, and Board of Directors. It is possible that, in the future, the Group will not get the financing it needs and this would have a negative effect on the Group's business and its development, especially on making acquisitions.

Interest risk: An interest risk in mainly due to the Group's short-term and long-term loans and the derivatives used for protecting them. Loans with fluctuating rates pose an interest risk to the Group's cash flow. This risk is decreased, for example, by using interest rate swap agreements. Interest rate hedging has been applied to more than half of the Group's loans.

Exchange rate risk: The Innofactor Group operates globally and is susceptible to risks related to the currencies of the countries in which it operates. Changes in exchange rates, especially the rates of Swedish krona and Norwegian krone, affect the Group's net sales and profitability as Innofactor has significant operations based on Swedish krona and Norwegian krone. The exchange rate risk is mainly due to the assets and liabilities registered in the balance sheet and the net investments made in the subsidiaries abroad. Also, the business contracts made by subsidiaries pose an exchange rate risk, although these contracts are mainly made in the currency the business unit uses in its operation. The management of exchange rate risks in the Group aims at minimizing the uncertainty that changes in exchange rates cause in the result through cash flows and assessment of receivables and liabilities.

Risks related to the cash position: The Innofactor Group handles management of liquid assets with the help of centralized payments and cash management. The Group strives for continuous monitoring and assessment of the needed business financing in order to ensure that the Group has enough liquid assets in its use. Additionally, the Group has overdraft facilities to cover any seasonal variations in liquid assets. Excess cash balance is placed on savings accounts or funds with capital guarantee.

Risks related to receivables from projects: A large part of Innofactor's net sales comes from project business. A significant part of projects consists of long-term projects in which scheduled payments and their terms may be agreed on with the customer beforehand. When Innofactor performs work in customer projects, which is scheduled to be invoiced afterwards, project receivables are accrued. Especially in public administration projects, scheduled payments often take place nearer to the end of the project, which means increased project receivables and related risks. In customer negotiations, Innofactor pays special attention to scheduling the payments and the size of payments, and in customer projects, to project management and steering in accordance with the scheduled payments. Project receivables are monitored regularly, on a monthly basis.

Credit risk: Credit decisions related to sales receivables are monitored centrally by the Group's management. Large part of Innofactor's cash flow comes through established customer relationships as payments from the public sector and financially sound companies, which have not presented essential credit risks in the past, and the Group has not suffered any significant credit losses. Should credit risks realize, it would weaken the Group's financial standing and liquidity. Sales receivables are monitored regularly.

Risks related to deferred tax assets: Innofactor's balance sheet includes deferred tax assets that are based on previous financial periods. Should the company's profitability decrease significantly in the long run, it is possible that the Group would not be able to utilize in full the receivables currently activated in the balance sheet.

Innofactor Plc has one auditor and, should the auditor not be an accounting firm or an independent accountant as specified in the applicable law, one deputy auditor is elected. Auditors are elected by the Innofactor Plc General Meeting and their term ends at the close of the first Annual General Meeting following the date of their election. The auditor is responsible for revisionof the company's accounts and providing the General Meeting with an auditor's report. The auditor's report is delivered to the Board of Directors at least two weeks before the date of the General Meeting. Auditors' responsibilities are described in greater detail in the FinnishAuditing Act.

Innofactor Plc's auditors present the General Meeting with all information concerning the company provided that such presentation is not likely to cause the company substantial harm.Auditors are not permitted to disclose to outsiders or individual shareholders any information concerning Innofactor Plc that has been acquired during the auditing process if such disclosure could damage the company, with the exception of cases where applicable legislation requires such information to be disclosed.

Auditors have both the right to be present and the right to be heard at Board meetings in which issues related to auditing tasks are discussed.

The Annual General Meeting of Innofactor Plc elected on 27 March 2024 Ernst & Young Oy, authorised public accountants, as the company's auditor for the 1 January–31 December 2024 financial period. The principal auditor is Juha Hilmola.

The Innofactor Plc Annual General Meeting has decided to pay the auditing fee according to a reasonable invoice.

The company's business name is Innofactor Oyj, Innofactor Plc in English, Innofactor Abp in Swedish, and its domicile is Espoo.

The company's field of business is consulting for management, marketing, finance and IT; import, export, manufacturing and trade of computer programs and equipment; and communications services. The company operates its business itself or through its subsidiaries. The company may own property and securities.

The company's shares belong to the book-entry system.

The company shall have a Board of Directors, which comprises at a minimum of four (4) and at a maximum of eight (8) members. The term of office of the members of the Board of Directors shall end at the close of the first Annual General Meeting following their election.

The company shall have a CEO who is elected by the Board of Directors.

Innofactor Plc can be represented by the Chairman of the Board of Directors or the company's CEO, or by two members of the Board of Directors acting together.

The company's accounts shall be audited by a certified accountant. If this auditor is not an authorised firm of public accountants, one deputy auditor shall be elected.

The auditors' term of office ends at the close of the first Annual General Meeting following their election.

The financial period of the company is a calendar year.

Invitations to General Meetings shall be published on the company's website in the Internet and shall conform to the requirements established for such invitations in Finland's Companies Act in all respects.

To participate in a General Meeting, shareholders must notify the company in the manner and (by the time stated in the invitation, such time being no earlier than ten (10) days prior to the date of the General Meeting General Meetings may be held at the company's domicile, in Helsinki or in Vantaa.

An Annual General Meeting shall be held each year no later than six (6) months after the end of the financial period on a day specified by the Board of Directors. At the Annual General Meeting, the following documents shall be presented:

1. The company's annual accounts, including the consolidated annual accounts, and the company's annual report, and

2. The auditor's report.

the following decisions shall be made:

3. Adoption of the annual accounts,

4. How the profit declared in the adopted balance sheet will be used,

5. The granting of discharge from liability to members of the Board of Directors and the CEO,

6. Remuneration of members of the Board of Directors and the auditors, and

7. The number of members and deputy members of the Board of Directors.

and the following elections will be made:

8. Members and deputy members of the Board of Directors, and

9. The Auditor and, if necessary, the Deputy Auditor.

The Articles of Association were updated in the Trade Register on April 23, 2013.